Will

Stockton Trigger Bankruptcy Run?

http://www.calwatchdog.com/2012/03/02/will-stockton-trigger-bankruptcy-run/

By WAYNE LUSVARDI

March 2, 2012

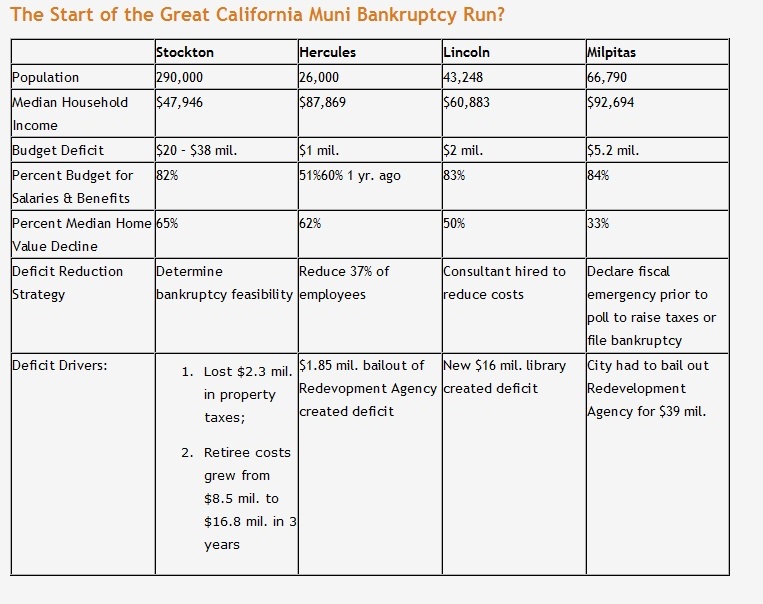

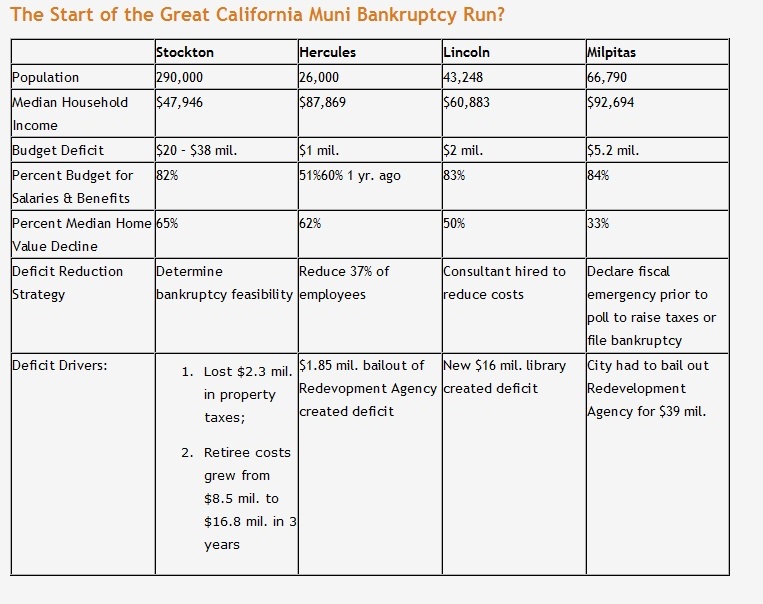

Stockton … Hercules … Lincoln … Milpitas. The list of cities has grown to four in the span of one week. These are all cities in California recently threatened with budgetary insolvency where expenses exceed revenues. All have started to explore filing bankruptcy or drastically reducing their budgets and effectively doing the same, as would happen in a bankruptcy court.

AB 506, by Assemblyman Bob Wieckowski, D-Fremont, became law in 2011 to prevent or delay just such a run of bankruptcy filings. The California Legislature does not want a run of cities filing bankruptcy because the state budget continues to run a $20 billion annual deficit and is unable to bail out insolvent cities.

AB 506 prohibits a municipal government from filing a federal bankruptcy unless

they it either:

Undegoes a neutral evaluation conducted by a third party and involving all interested

parties, including unions and creditors. This applies to the cities of Stockton,

Hercules and Lincoln; or

Declares a “fiscal emergency” that threatens the health, safety or

well-being or residents without bankruptcy protections. This applies to the

city of Milpitas.

The city of Stockton has initiated the mandated neutral evaluation process preparatory to filing bankruptcy. The city of Milpitas has declared a “fiscal emergency,” preparatory to raising taxes or filing bankruptcy if a tax ballot initiative fails. The cities of Hercules and Lincoln have drastically reduced their budgets, as they would be forced to do by a bankruptcy judge. But they are all in the same “fiscal” boat with budget deficits.

Stockton

For Stockton, it was overbuilding of homes during the Mortgage Bubble, reliance on redevelopment projects that now have gone bust and the fast growth in public pension costs. Retiree pension costs have risen from $8.5 million per year in 2007-08 to $16.8 million in 2010-11, and the proportion of costs may continue to rise. The median home value has dropped about 65 percent compared to about 33 percent on average in California since 2006 (CityData.com).

In 2011, Stockton had a $3.98 million hole in its operating budget to patch. The sources of that hole were: $2,323,600 in declining property taxes, a $1,047,000 loss of vehicle license fees and $700,000 in fire department overtime. SB 89 diverted $130 million in vehicle license fees statewide from cities to counties to help pay for prison realignment..

Each city has its own unique story as to how they ended up with an insolvent budget.

Hercules

For the City of Hercules, located in the north San Francisco Bay, the median home price has plummeted from $650,000 in 2006 to $250,000 in the third quarter of 2011 (CityData.com). That reflects a whopping 62 percent decline and a decreasing property tax base. Hercules took a $1.85 million hit to bail out its redevelopment agency when Gov. Jerry Brown ended redevelopment this year. That bailout pushed the city into a $1 million deficit on its budget balance sheet. Hercules lost $87,107 in vehicle license fee revenues under prison realignment.

Lincoln

For Lincoln, a small community north of Sacramento, it was the debt on a new $16 million library that pushed its budget into a $2 million annual deficit. According to CityData.com, the median home value in Lincoln dropped from $500,000 in 2006 to $250,000 in the third quarter of 2011, a 50 percent decline. Lincoln lost $146,154 in vehicle license fees under prison realignment.

Milpitas

Milpitas, a suburb of San Jose located in the South Bay, was hit with a $39 million cost to bail out its redevelopment agency, which shoved the city budget into a deficit. Median home values have declined relatively more modestly in Milpitas, from $600,000 in 2006 to $400,00 by the third quarter of 2011, reflecting a 33 percent decline, according to CityData.com. Milpitas lost $252,859 in vehicle license fees under prison realignment in a city running a $5.2 million budget deficit.

Bankruptcy as ‘Reputational Stain’

The biggest decline in municipal revenues has been in sales taxes, however, for all cities. If it were not for Proposition 13, property taxes would have declined even further. Prop. 13 has a “circuit breaker” built in to it to prevent a free fall in property taxes. Cities also lost the revenues from vehicle license fees in 2011.

State Treasurer Bill Lockyer was quoted in the Wall Street Journal saying he wants to avoid the “reputational stain” of a wave of municipal bankruptcies because it would make it difficult for the state to raise funds in the bond markets. Bond underwriter Richard Larkin of Herbert J. Sims Co. said that, as the number of bankruptcies mounts, bond interest rates will rise. AB 506 may not be enough to push back a tidal wave of bankruptcies and higher bond borrowing costs from happening.

In turn, those higher bond interest rate costs will be added to the debt line item in city, county and state budgets, putting more pressure on other line items in each budget. Cities are caught in a downward spiral of revenues that local tax initiatives may not be able to entirely fix. As revenues continue to ratchet downward any, “tax fix” may only be temporary, requiring yet another and another tax fix. Bankruptcy, or voluntary budget reductions, may be a better way to go because either offers a way to control costs instead of a death spiral that tries endlessly to raise revenues even as the tax increases themselves drag the city down.