The Financial New World Order: Towards a Global Currency and World Government

The Financial New World Order: Towards a Global Currency and World Government

By Andrew G. Marshall

Global Research, April 6, 2009

www.globalresearch.ca/index.php?context=va&aid=13070

Introduction

Following the 2009 G20 summit, plans were announced for implementing the creation

of a new global currency to replace the US dollar’s role as the world reserve

currency. Point 19 of the communiqué released by the G20 at the end of

the Summit stated, “We have agreed to support a general SDR allocation

which will inject $250bn (£170bn) into the world economy and increase

global liquidity.” SDRs, or Special Drawing Rights, are “a synthetic

paper currency issued by the International Monetary Fund.” As the Telegraph

reported, “the G20 leaders have activated the IMF's power to create money

and begin global "quantitative easing". In doing so, they are putting

a de facto world currency into play. It is outside the control of any sovereign

body. Conspiracy theorists will love it.”[1]

The article continued in stating that, “There is now a world currency in

waiting. In time, SDRs are likely to evolve into a parking place for the foreign

holdings of central banks, led by the People's Bank of China.” Further,

“The creation of a Financial Stability Board looks like the first step

towards a global financial regulator,” or, in other words, a global central

bank.

It is important to take a closer look at these “solutions” being proposed and implemented in the midst of the current global financial crisis. These are not new suggestions, as they have been in the plans of the global elite for a long time. However, in the midst of the current crisis, the elite have fast-tracked their agenda of forging a New World Order in finance. It is important to address the background to these proposed and imposed “solutions” and what effects they will have on the International Monetary System (IMS) and the global political economy as a whole.

A New Bretton-Woods

In October of 2008, Gordon Brown, Prime Minister of the UK, said that we “must

have a new Bretton Woods - building a new international financial architecture

for the years ahead.” He continued in saying that, “we must now reform

the international financial system around the agreed principles of transparency,

integrity, responsibility, good housekeeping and co-operation across borders.”

An article in the Telegraph reported that Gordon Brown would want “to see

the IMF reformed to become a ‘global central bank’ closely monitoring

the international economy and financial system.”[2]

On October 17, 2008, Prime Minister Gordon Brown wrote an op-ed in the Washington

Post in which he said, “This week, European leaders came together to propose

the guiding principles that we believe should underpin this new Bretton Woods:

transparency, sound banking, responsibility, integrity and global governance.

We agreed that urgent decisions implementing these principles should be made

to root out the irresponsible and often undisclosed lending at the heart of

our problems. To do this, we need cross-border supervision of financial institutions;

shared global standards for accounting and regulation; a more responsible approach

to executive remuneration that rewards hard work, effort and enterprise but

not irresponsible risk-taking; and the renewal of our international institutions

to make them effective early-warning systems for the world economy.[Emphasis

added]”[3]

In early October 2008, it was reported that, “as the world's central bankers

gather this week in Washington DC for an IMF-World Bank conference to discuss

the crisis, the big question they face is whether it is time to establish a

global economic "policeman" to ensure the crash of 2008 can never

be repeated.” Further, “any organisation with the power to police

the global economy would have to include representatives of every major country

– a United Nations of economic regulation.” A former governor of the

Bank of England suggested that, “the answer might already be staring us

in the face, in the form of the Bank for International Settlements (BIS),”

however, “The problem is that it has no teeth. The IMF tends to couch its

warnings about economic problems in very diplomatic language, but the BIS is

more independent and much better placed to deal with this if it is given the

power to do so.”[4]

Emergence of Regional Currencies

On January 1, 1999, the European Union established the Euro as its regional

currency. The Euro has grown in prominence over the past several years. However,

it is not to be the only regional currency in the world. There are moves and

calls for other regional currencies throughout the world.

In 2007, Foreign Affairs, the journal of the Council on Foreign Relations, ran

an article titled, The End of National Currency, in which it began by discussing

the volatility of international currency markets, and that very few “real”

solutions have been proposed to address successive currency crises. The author

poses the question, “will restoring lost sovereignty to governments put

an end to financial instability?” He answers by stating that, “This

is a dangerous misdiagnosis,” and that, “The right course is not to

return to a mythical past of monetary sovereignty, with governments controlling

local interest and exchange rates in blissful ignorance of the rest of the world.

Governments must let go of the fatal notion that nationhood requires them to

make and control the money used in their territory. National currencies and

global markets simply do not mix; together they make a deadly brew of currency

crises and geopolitical tension and create ready pretexts for damaging protectionism.

In order to globalize safely, countries should abandon monetary nationalism

and abolish unwanted currencies, the source of much of today's instability.”

The author explains that, “Monetary nationalism is simply incompatible

with globalization. It has always been, even if this has only become apparent

since the 1970s, when all the world's governments rendered their currencies

intrinsically worthless.” The author states that, “Since economic

development outside the process of globalization is no longer possible, countries

should abandon monetary nationalism. Governments should replace national currencies

with the dollar or the euro or, in the case of Asia, collaborate to produce

a new multinational currency over a comparably large and economically diversified

area.” Essentially, according to the author, the solution lies in regional

currencies.[5]

In October of 2008, “European Central Bank council member Ewald Nowotny

said a ``tri-polar'' global currency system is developing between Asia, Europe

and the U.S. and that he's skeptical the U.S. dollar's centrality can be revived.”[6]

The Union of South American Nations

The Union of South American Nations (UNASUR) was established on May 23, 2008,

with the headquarters to be in Ecuador, the South American Parliament to be

in Bolivia, and the Bank of the South to be in Venezuela. As the BBC reported,

“The leaders of 12 South American nations have formed a regional body aimed

at boosting economic and political integration in the region,” and that,

“The Unasur members are Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador,

Guyana, Paraguay, Peru, Suriname, Uruguay and Venezuela.”[7]

The week following the announcement of the Union, it was reported that, “Brazilian

President Luiz Inacio Lula da Silva said Monday that South American nations

will seek a common currency as part of the region's integration efforts following

the creation of the Union of South American Nations.” He was quoted as

saying, “We are proceeding so as, in the future, we have a common central

bank and a common currency.”[8]

The Gulf Cooperation Council and a Regional Currency

In 2005, the Gulf Cooperation Council (GCC), a regional trade bloc among Bahrain,

Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates (UAE), announced

the goal of creating a single common currency by 2010. It was reported that,

“An economically united and efficient GCC is clearly a more interesting

proposition for larger companies than each individual economy, especially given

the impediments to trade evident within the region. This is why trade relations

within the GCC have been a core focus of late.” Further, “The natural

extension of this trend for increased integration is to introduce a common currency

in order to further facilitate trade between the different countries.”

It was announced that, “the region's central bankers had agreed to pursue

monetary union in a similar fashion to the rules used in Europe.”[9]

In June of 2008, it was reported that, “Gulf Arab central bankers agreed

to create the nucleus of a joint central bank next year in a major step forward

for monetary union but signaled that a new common currency would not be in circulation

by an agreed 2010 target.”[10] In 2002, it was announced that the “Gulf

states say they are seeking advice from the European Central Bank on their monetary

union programme.” In February of 2008, Oman announced that it would not

be joining the monetary union. In November of 2008, it was announced that the

“Final monetary union draft says Gulf central bank will be independent

from governments of member states.”[11]

In March of 2009, it was reported that, “The GCC should not rush into forming

a single currency as member states need to work out the framework for a regional

central bank, Saudi Arabia's Central Bank Governor Muhammad Al Jasser.”

Jasser was further quoted as saying, “It took the European Union 45 years

to put together a single currency. We should not rush.” In 2008, with the

global financial crisis, new problems were posed for the GCC initiative, as

“Pressure mounted last year on the GCC members to drop their currency pegs

as inflation accelerated above 10 per cent in five of the six countries. All

of the member states except Kuwait peg their currencies to the dollar and tend

to follow the US Federal Reserve when setting interest rates.”[12]

An Asian Monetary Union

In 1997, the Brookings Institution, a prominent American think tank, discussed

the possibilities of an East Asian Monetary Union, stating that, “the question

for the 21st century is whether analogous monetary blocs will form in East Asia

(and, for that matter, in the Western Hemisphere). With the dollar, the yen,

and the single European currency floating against one another, other small open

economies will be tempted to link up to one of the three.” However, “the

linkage will be possible only if accompanied by radical changes in institutional

arrangements like those contemplated by the European Union. The spread of capital

mobility and political democratization will make it prohibitively difficult

to peg exchange rates unilaterally. Pegging will require international cooperation,

and effective cooperation will require measures akin to monetary unification.”[13]

In 2001, Asia Times Online wrote an article discussing a speech given by economist

Robert A. Mundell at Bangkok's Chulalongkorn University, at which he stated

that, “[t]he "Asean plus three" (the 10 members of the Association

of Southeast Asian Nations plus China, Japan, and Korea) ‘should look to

the European Union as a model for closer integration of monetary policy, trade

and eventually, currency integration’.”[14]

On May 6, 2005, the website of the Association of Southeast Asian Nations (ASEAN)

announced that, “China, Japan, South Korea and the 10 members of the Association

of Southeast Asian Nations (ASEAN) have agreed to expand their network of bilateral

currency swaps into what could become a virtual Asian Monetary Fund,” and

that, “[f]inance officials of the 13 nations, who met in the sidelines

of the Asian Development Bank (ADB) annual conference in Istanbul, appeared

determined to turn their various bilateral agreements into some sort of multilateral

accord, although none of the officials would directly call it an Asian Monetary

Fund.”[15]

In August of 2005, the San Francisco Federal Reserve Bank published a report

on the prospects of an East Asian Monetary Union, stating that East Asia satisfies

the criteria for joining a monetary union, however, it states that compared

to the European initiative, “The implication is that achieving any monetary

arrangement, including a common currency, is much more difficult in East Asia.”

It further states that, “In Europe, a monetary union was achievable primarily

because it was part of the larger process of political integration,” however,

“There is no apparent desire for political integration in East Asia, partly

because of the great differences among those countries in terms of political

systems, culture, and shared history. As a result of their own particular histories,

East Asian countries remain particularly jealous of their sovereignty.”

Another major problem, as presented by the San Francisco Fed, is that, “East

Asian governments appear much more suspicious of strong supranational institutions,”

and thus, “in East Asia, sovereignty concerns have left governments reluctant

to delegate significant authority to supranational bodies, at least so far.”

It explains that as opposed to the steps taken to create a monetary union in

Europe, “no broad free trade agreements have been achieved among the largest

countries in the region, Japan, Korea, Taiwan, and China.” Another problem

is that, “East Asia does not appear to have an obvious candidate for an

internal anchor currency for a cooperative exchange rate arrangement. Most successful

new currencies have been started on the back of an existing currency, establishing

confidence in its convertibility, thus linking the old with the new.”

The report concludes that, “exchange rate stabilization and monetary integration

are unlikely in the near term. Nevertheless, East Asia is integrating through

trade, even without an emphasis on formal trade liberalization agreements,”

and that, “there is evidence of growing financial cooperation in the region,

including the development of regional arrangements for providing liquidity during

crises through bilateral foreign exchange swaps, regional economic surveillance

discussions, and the development of regional bond markets.” Ultimately,

“East Asia might also proceed along the same path [as Europe], first with

loose agreements to stabilize currencies, followed later by tighter agreements,

and culminating ultimately in adoption of a common anchorand, after that,

maybe an East Asia dollar.”[16]

In 2007, it was reported that, “Asia may need to establish its own monetary

fund if it is to cope with future financial shocks similar to that which rocked

the region 10 years ago,” and that, “Further Asian financial integration

is the best antidote for Asian future financial crises.”[17]

In September of 2007, Forbes reported that, “An East Asian monetary union

anchored by Japan is feasible but the region lacks the political will to do

it, the Asian Development Bank said.” Pradumna Rana, an Asian Development

Bank (ADB) economist, said that, “it appears feasible to establish a currency

union in East Asia -- particularly among Indonesia, Japan, (South) Korea, Malaysia,

Philippines, Singapore and Thailand,” and that, “The economic potential

for monetary integration in Asia is strong, even though the political underpinnings

of such an accord are not yet in place.” Further, “the real integration

at the trade levels 'will actually reinforce the economic case for monetary

union in Asia, in a similar way that real-sector integration did so in Europe,”

and ultimately, “the road to an Asian monetary union could proceed on a

'multi-track, multi-speed' basis with a seamless Asian free trade area the goal

on the trade side.”[18] In April of 2008, it was reported that, “ASEAN

bank deputy governors and financial deputy ministers have met in Vietnam's central

Da Nang city, discussing issues on the financial and monetary integration and

cooperation in the region.”[19]

African Monetary Union

Currently, Africa has several different monetary union initiatives, as well

as some existing monetary unions within the continent. One initiative is the

“monetary union project of the Economic Community of West African States

(ECOWAS),” which is a “regional group of 15 countries in West Africa.”

Among the members are those of an already-existing monetary union in the region,

the West African Economic and Monetary Union (WAEMU). The ECOWAS consists of

Benin, Burkina Faso, Cote d’Ivoire, Guinea, Guinea Bissau, Mali, Niger,

Senegal, Sierra Leone, Togo, Cape Verde, Liberia, Ghana, Gambia, and Nigeria.[20]

The African Union was founded in 2002, and is an intergovernmental organization

consisting of 53 African states. In 2003, the Brookings Institution produced

a paper on African economic integration. In it, the authors started by stating

that, “Africa, like other regions of the world, is fixing its sights on

creating a common currency. Already, there are projects for regional monetary

unions, and the bidding process for an eventual African central bank is about

to begin.” It states that, “A common currency was also an objective

of the Organization for African Unity and the African Economic Community, the

predecessors of the AU,” and further, that, “The 1991 Abuja Treaty

establishing the African Economic Community outlines six stages for achieving

a single monetary zone for Africa that were set to be completed by approximately

2028. In the early stages, regional cooperation and integration within Africa

would be strengthened, and this could involve regional monetary unions. The

final stage involves the establishment of the African Central Bank (ACB) and

creation of a single African currency and an African Economic and Monetary Union.”

The paper further states that the African Central Bank (ACB) “would not

be created until around 2020, [but] the bidding process for its location is

likely to begin soon,” however, “there are plans for creating various

regional monetary unions, which would presumably form building blocks for the

single African central bank and currency.”[21]

In August of 2008, “Governors of African Central Banks convened in Kigali

Serena Hotel to discuss issues concerning the creation of three African Union

(AU) financial institutions,” following “the AU resolution to form

the African Monetary Fund (AMF), African Central Bank (ACB) and the African

Investment Bank (AIB).” The central bank governors “agreed that when

established, the ACB would solely issue and manage Africa's single currency

and monetary authority of the continent's economy.”[22]

On March 2, 2009, it was reported that, “The African Union will sign a

memorandum of understanding this month with Nigeria on the establishment of

a continental central bank,” and that, “The institution will be based

in the Nigerian capital, Abuja, African Union Commissioner for Economic Affairs

Maxwell Mkwezalamba told reporters.” Further, “As an intermediate

step to the creation of the bank, the pan- African body will establish an African

Monetary Institute within the next three years, he said at a meeting of African

economists in the city,” and he was quoted as saying, “We have agreed

to work with the Association of African Central Bank Governors to set up a joint

technical committee to look into the preparation of a joint strategy.”[23]

The website for the Kenyan Ministry of Foreign Affairs reported that, “The

African Union Commissioner for Economic Affairs Dr. Maxwell Mkwezalamba has

expressed optimism for the adoption of a common currency for Africa,” and

that the main theme discussed at the AU Commission meeting in Kenya was, “Towards

the Creation of a Single African Currency: Review of the Creation of a Single

African Currency: Which optimal Approach to be adopted to accelerate the creation

of the unique continental currency.”[24]

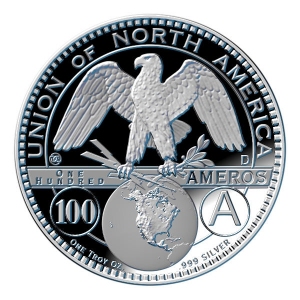

A North American Monetary Union and the Amero

In January of 2008, I wrote an article documenting the moves toward the creation

of a North American currency, likely under the name Amero. [See: Andrew G. Marshall,

North-American Monetary Integration: Here Comes the Amero. Global Research:

January 20, 2008] I will briefly outline the information presented in that article

here.

In 1999, the Fraser Institute, a prominent and highly influential Canadian think

tank, published a report written by Economics professor and former MP, Herbert

Grubel, called, The Case for the Amero: The Economics and Politics of a North

American Monetary Union. He wrote that, “The plan for a North American

Monetary Union presented in this study is designed to include Canada, the United

States, and Mexcio,” and a “North American Central Bank, like the

European Central Bank, will have a constitution making it responsible only for

the maintenance of price stability and not for full employment.”[25] He

opined that, “sovereignty is not infinitely valuable. The merit of giving

up some aspects of sovereignty should be determined by the gains brought by

such a sacrifice,” and that, “It is important to note that in practice

Canada has given up its economic sovereignty in many areas, the most important

of which involve the World Trade Organization (formerly the GATT), the North

American Free Trade Agreement,” as well as the International Monetary Fund

and World Bank.[26]

Also in 1999, the C.D. Howe Institute, another of Canada’s most prominent

think tanks, produced a report titled, From Fixing to Monetary Union: Options

for North American Currency Integration. In this document, it was written that,

“The easiest way to broach the notion of a NAMU [North American Monetary

Union] is to view it as the North American equivalent of the European Monetary

Union (EMU) and, by extension, the euro.”[27] It further stated that the

fact that “a NAMU would mean the end of sovereignty in Canadian monetary

policy is clear. Most obviously, it would mean abandoning a made-in-Canada inflation

rate for a US or NAMU inflation rate.”[28]

In May of 2007, Canada’s then Governor of the Central Bank of Canada, David

Dodge, said that, “North America could one day embrace a euro-style single

currency,” and that, “Some proponents have dubbed the single North

American currency the ‘amero’.” Answering questions following

his speech, Dodge said that, “a single currency was ‘possible’.”[29]

In November of 2007, one of Canada’s richest billionaires, Stephen Jarislowsky,

also a member of the board of the C.D. Howe Institute, told a Canadian Parliamentary

committee that, “Canada should replace its dollar with a North American

currency, or peg it to the U.S. greenback, to avoid the exchange rate shifts

the loonie has experienced,” and that, “I think we have to really

seriously start thinking of the model of a continental currency just like Europe.”[30]

Former Mexican President Vicente Fox, while appearing on Larry King Live in

2007, was asked a question regarding the possibility of a common currency for

Latin America, to which he responded by saying, “Long term, very long term.

What we propose together, President Bush and myself, it's ALCA, which is a trade

union for all of the Americas. And everything was running fluently until Hugo

Chavez came. He decided to isolate himself. He decided to combat the idea and

destroy the idea.” Larry King then asked, “It's going to be like the

euro dollar, you mean?” to which Fox responded, “Well, that would

be long, long term. I think the processes to go, first step into is trading

agreement. And then further on, a new vision, like we are trying to do with

NAFTA.”[31]

In January of 2008, Herbert Grubel, the author who coined the term “amero”

for the Fraser Institute report, wrote an article for the Financial Post, in

which he recommends fixing the Canadian loonie to the US dollar at a fixed exchange

rate, but that there are inherent problems with having the US Federal Reserve

thus control Canadian interest rates. He then wrote that, “there is a solution

to this lack of credibility. In Europe, it came through the creation of the

euro and formal end of the ability of national central banks to set interest

rates. The analogous creation of the amero is not possible without the unlikely

co-operation of the United States. This leaves the credibility issue to be solved

by the unilateral adoption of a currency board, which would ensure that international

payments imbalances automatically lead to changes in Canada's money supply and

interest rates until the imbalances are ended, all without any actions by the

Bank of Canada or influence by politicians. It would be desirable to create

simultaneously the currency board and a New Canadian Dollar valued at par with

the U.S. dollar. With longer-run competitiveness assured at US90¢ to the

U.S. dollar.”[32]

In January of 2009, an online publication of the Wall Street Journal, called

Market Watch, discussed the possibility of hyperinflation of the United States

dollar, and then stated, regarding the possibility of an amero, “On its

face, while difficult to imagine, it makes intuitive sense. The ability to combine

Canadian natural resources, American ingenuity and cheap Mexican labor would

allow North America to compete better on a global stage.” The author further

states that, “If forward policy attempts to induce more debt rather than

allowing savings and obligations to align, we must respect the potential for

a system shock. We may need to let a two-tier currency gain traction if the

dollar meaningfully debases from current levels,” and that, “If this

dynamic plays out -- and I've got no insight that it will -- the global balance

of powers would fragment into four primary regions: North America, Europe, Asia

and the Middle East. In such a scenario, ramifications would manifest through

social unrest and geopolitical conflict.”[33]

A Global Currency

The Phoenix

In 1988, The Economist ran an article titled, Get Ready for the Phoenix, in

which they wrote, “THIRTY years from now, Americans, Japanese, Europeans,

and people in many other rich countries and some relatively poor ones will probably

be paying for their shopping with the same currency. Prices will be quoted not

in dollars, yen or D-marks but in, let's say, the phoenix. The phoenix will

be favoured by companies and shoppers because it will be more convenient than

today's national currencies, which by then will seem a quaint cause of much

disruption to economic life in the late twentieth century.”

The article stated that, “The market crash [of 1987] taught [governments]

that the pretence of policy cooperation can be worse than nothing, and that

until real co-operation is feasible (ie, until governments surrender some economic

sovereignty) further attempts to peg currencies will flounder.” Amazingly

the article states that, “Several more big exchange-rate upsets, a few

more stockmarket crashes and probably a slump or two will be needed before politicians

are willing to face squarely up to that choice. This points to a muddled sequence

of emergency followed by patch-up followed by emergency, stretching out far

beyond 2018-except for two things. As time passes, the damage caused by currency

instability is gradually going to mount; and the very trends that will make

it mount are making the utopia of monetary union feasible.”

Further, the article stated that, “The phoenix zone would impose tight

constraints on national governments. There would be no such thing, for instance,

as a national monetary policy. The world phoenix supply would be fixed by a

new central bank, descended perhaps from the IMF. The world inflation rate-and

hence, within narrow margins, each national inflation rate-would be in its charge.

Each country could use taxes and public spending to offset temporary falls in

demand, but it would have to borrow rather than print money to finance its budget

deficit.” The author admits that, “This means a big loss of economic

sovereignty, but the trends that make the phoenix so appealing are taking that

sovereignty away in any case. Even in a world of more-or-less floating exchange

rates, individual governments have seen their policy independence checked by

an unfriendly outside world.”

The article concludes in stating that, “The phoenix would probably start

as a cocktail of national currencies, just as the Special Drawing Right is today.

In time, though, its value against national currencies would cease to matter,

because people would choose it for its convenience and the stability of its

purchasing power.” The last sentence states, “Pencil in the phoenix

for around 2018, and welcome it when it comes.”[34]

Recommendations for a Global Currency

In 1998, the IMF Survey discussed a speech given by James Tobin, a prominent

American economist, in which he argued that, “A single global currency

might offer a viable alternative to the floating rate.” He further stated

that, “there was still a great need” for “lenders of last resort.”[35]

In 1999, economist Judy Shelton addressed the US House of Representatives Committee

on Banking and Financial Services. In her testimony, she stated that, “The

continued expansion of free trade, the increased integration of financial markets

and the advent of electronic commerce are all working to bring about the need

for an international monetary standard---a global unit of account.” She

further explained that, “Regional currency unions seem to be the next step

in the evolution toward some kind of global monetary order. Europe has already

adopted a single currency. Asia may organize into a regional currency bloc to

offer protection against speculative assaults on the individual currencies of

weaker nations. Numerous countries in Latin America are considering various

monetary arrangements to insulate them from financial contagion and avoid the

economic consequences of devaluation. An important question is whether this

process of monetary evolution will be intelligently directed or whether it will

simply be driven by events. In my opinion, political leadership can play a decisive

role in helping to build a more orderly, rational monetary system than the current

free-for-all approach to exchange rate relations.”

She further stated that, “As we have seen in Europe, the sequence of development

is (1) you build a common market, and (2) you establish a common currency. Indeed,

until you have a common currency, you don’t truly have an efficient common

market.” She concludes by stating, “Ideally, every nation should stand

willing to convert its currency at a fixed rate into a universal reserve asset.

That would automatically create a global monetary union based on a common unit

of account. The alternative path to a stable monetary order is to forge a common

currency anchored to an asset of intrinsic value. While the current momentum

for dollarization should be encouraged, especially for Mexico and Canada, in

the end the stability of the global monetary order should not rest on any single

nation.”[36]

Paul Volcker, former Governor of the Federal Reserve Board, stated in 2000,

that, “If we are to have a truly global economy, a single world currency

makes sense.” In a speech delivered by a member of the Executive Board

of the European Central Bank, it was stated that Paul Volcker “might be

right, and we might one day have a single world currency. Maybe European integration,

in the same way as any other regional integration, could be seen as a step towards

the ideal situation of a fully integrated world. If and when this world will

see the light of day is impossible to say. However, what I can say is that this

vision seems as impossible now to most of us as a European monetary union seemed

50 years ago, when the process of European integration started.”[37]

In 2000, the IMF held an international conference and published a brief report

titled, One World, One Currency: Destination or Delusion?, in which it was stated

that, “As perceptions grow that the world is gradually segmenting into

a few regional currency blocs, the logical extension of such a trend also emerges

as a theoretical possibility: a single world currency. If so many countries

see benefits from currency integration, would a world currency not maximize

these benefits?”

It outlines how, “The dollar bloc, already underpinned by the strength

of the U.S. economy, has been extended further by dollarization and regional

free trade pacts. The euro bloc represents an economic union that is intended

to become a full political union likely to expand into Central and Eastern Europe.

A yen bloc may emerge from current proposals for Asian monetary cooperation.

A currency union may emerge among Mercosur members in Latin America, a geographical

currency zone already exists around the South African rand, and a merger of

the Australian and New Zealand dollars is a perennial topic in Oceania.”

The summary states that, “The same commercial efficiencies, economies of

scale, and physical imperatives that drive regional currencies together also

presumably exist on the next levelthe global scale.” Further, it reported

that, “The smaller and more vulnerable economies of the worldthose

that the international community is now trying hardest to helpwould have

most to gain from the certainty and stability that would accompany a single

world currency.”[38] Keep in mind, this document was produced by the IMF,

and so its recommendations for what it says would likely “help” the

smaller and more vulnerable countries of the world, should be taken with a grain

– or bucket – of salt.

Economist Robert A. Mundell has long called for a global currency. On his website,

he states that the creation of a global currency is “a project that would

restore a needed coherence to the international monetary system, give the International

Monetary Fund a function that would help it to promote stability, and be a catalyst

for international harmony.” He states that, “The benefits from a world

currency would be enormous. Prices all over the world would be denominated in

the same unit and would be kept equal in different parts of the world to the

extent that the law of one price was allowed to work itself out. Apart from

tariffs and controls, trade between countries would be as easy as it is between

states of the United States.”[39]

Renewed Calls for a Global Currency

On March 16, 2009, Russia suggested that, “the G20 summit in London in

April should start establishing a system of managing the process of globalization

and consider the possibility of creating a supra-national reserve currency or

a ‘super-reserve currency’.” Russia called for “the creation

of a supra-national reserve currency that will be issued by international financial

institutions,” and that, “It looks expedient to reconsider the role

of the IMF in that process and also to determine the possibility and need for

taking measures that would allow for the SDRs (Special Drawing Rights) to become

a super-reserve currency recognized by the world community.”[40]

On March 23, 2009, it was reported that China’s central bank “proposed

replacing the US dollar as the international reserve currency with a new global

system controlled by the International Monetary Fund.” The goal would be

for the world reserve currency that is “disconnected from individual nations

and is able to remain stable in the long run, thus removing the inherent deficiencies

caused by using credit-based national currencies.” The chief China economist

for HSBC stated that, “This is a clear sign that China, as the largest

holder of US dollar financial assets, is concerned about the potential inflationary

risk of the US Federal Reserve printing money.” The Governor of the People’s

Bank of China, the central bank, “suggested expanding the role of special

drawing rights, which were introduced by the IMF in 1969 to support the Bretton

Woods fixed exchange rate regime but became less relevant once that collapsed

in the 1970s.” Currently, “the value of SDRs is based on a basket

of four currencies – the US dollar, yen, euro and sterling – and they

are used largely as a unit of account by the IMF and some other international

organizations.”

However, “China’s proposal would expand the basket of currencies forming

the basis of SDR valuation to all major economies and set up a settlement system

between SDRs and other currencies so they could be used in international trade

and financial transactions. Countries would entrust a portion of their SDR reserves

to the IMF to manage collectively on their behalf and SDRs would gradually replace

existing reserve currencies.”[41]

On March 25, Timothy Geithner, Treasury Secretary and former President of the

New York Federal Reserve, spoke at the Council on Foreign Relations, when asked

a question about his thoughts on the Chinese proposal for the global reserve

currency, Geithner replied that, “I haven't read the governor's proposal.

He's a remarkably -- a very thoughtful, very careful, distinguished central

banker. Generally find him sensible on every issue. But as I understand his

proposal, it's a proposal designed to increase the use of the IMF's special

drawing rights. And we're actually quite open to that suggestion. But you should

think of it as rather evolutionary, building on the current architectures, than

-- rather than -- rather than moving us to global monetary union [Emphasis added].”[42]

In late March, it was reported that, “A United Nations panel of economists

has proposed a new global currency reserve that would take over the US dollar-based

system used for decades by international banks,” and that, “An independently

administered reserve currency could operate without conflicts posed by the US

dollar and keep commodity prices more stable.”[43]

A recent article in the Economic Times stated that, “The world is not yet

ready for an international reserve currency, but is ready to begin the process

of shifting to such a currency. Otherwise, it would remain too vulnerable to

the hegemonic nation,” as in, the United States.[44] Another article in

the Economic Times started by proclaiming that, “the world certainly needs

an international currency.” Further, the article stated that, “With

an unwillingness to accept dollars and the absence of an alternative, international

payments system can go into a freeze beyond the control of monetary authorities

leading the world economy into a Great Depression,” and that, “In

order to avoid such a calamity, the international community should immediately

revive the idea of the Substitution Account mooted in 1971, under which official

holders of dollars can deposit their unwanted dollars in a special account in

the IMF with the values of deposits denominated in an international currency

such as the SDR of the IMF.”[45]

Amidst fears of a falling dollar as a result of the increased open discussion

of a new global currency, it was reported that, “The dollar’s role

as a reserve currency won’t be threatened by a nine-fold expansion in the

International Monetary Fund’s unit of account, according to UBS AG, ING

Groep NV and Citigroup Inc.” This was reported following the recent G20

meeting, at which, “Group of 20 leaders yesterday gave approval for the

agency to raise $250 billion by issuing Special Drawing Rights, or SDRs, the

artificial currency that the IMF uses to settle accounts among its member nations.

It also agreed to put another $500 billion into the IMF’s war chest.”[46]

In other words, the large global financial institutions came to the rhetorical

rescue of the dollar, so as not to precipitate a crisis in its current standing,

so that they can continue with quietly forming a new global currency.

Creating a World Central Bank

In 1998, Jeffrey Garten wrote an article for the New York Times advocating a

“global Fed.” Garten was former Dean of the Yale School of Management,

former Undersecretary of Commerce for International Trade in the Clinton administration,

previously served on the White House Council on International Economic Policy

under the Nixon administration and on the policy planning staffs of Secretaries

of State Henry Kissinger and Cyrus Vance of the Ford and Carter administrations,

former Managing Director at Lehman Brothers, and is a member of the Council

on Foreign Relations. In his article written in 1998, he stated that, “over

time the United States set up crucial central institutions -- the Securities

and Exchange Commission (1933), the Federal Deposit Insurance Corporation (1934)

and, most important, the Federal Reserve (1913). In so doing, America became

a managed national economy. These organizations were created to make capitalism

work, to prevent destructive business cycles and to moderate the harsh, invisible

hand of Adam Smith.”

He then explained that, “This is what now must occur on a global scale.

The world needs an institution that has a hand on the economic rudder when the

seas become stormy. It needs a global central bank.” He explains that,

“Simply trying to coordinate the world's powerful central banks -- the

Fed and the new European Central Bank, for instance -- wouldn't work,”

and that, “Effective collaboration among finance ministries and treasuries

is also unlikely to materialize. These agencies are responsible to elected legislatures,

and politics in the industrial countries is more preoccupied with internal events

than with international stability.”

He then postulates that, “An independent central bank with responsibility

for maintaining global financial stability is the only way out. No one else

can do what is needed: inject more money into the system to spur growth, reduce

the sky-high debts of emerging markets, and oversee the operations of shaky

financial institutions. A global central bank could provide more money to the

world economy when it is rapidly losing steam.” Further, “Such a bank

would play an oversight role for banks and other financial institutions everywhere,

providing some uniform standards for prudent lending in places like China and

Mexico. [However, t]he regulation need not be heavy-handed.” Garten continues,

“There are two ways a global central bank could be financed. It could have

lines of credit from all central banks, drawing on them in bad times and repaying

when the markets turn up. Alternately -- and admittedly more difficult to carry

out -- it could be financed by a very modest tariff on all trade, collected

at the point of importation, or by a tax on certain global financial transactions.”

Interestingly, Garten states that, “One thing that would not be acceptable

would be for the bank to be at the mercy of short-term-oriented legislatures.”

In essence, it is not to be accountable to the people of the world. So, he asks

the question, “To whom would a global central bank be accountable? It would

have too much power to be governed only by technocrats, although it must be

led by the best of them. One possibility would be to link the new bank to an

enlarged Group of Seven -- perhaps a ''G-15'' [or in today’s context, the

G20] that would include the G-7 plus rotating members like Mexico, Brazil, South

Africa, Poland, India, China and South Korea.” He further states that,

“There would have to be very close collaboration” between the global

bank and the Fed, and that, “The global bank would not operate within the

United States, and it would not be able to override the decisions of our central

bank. But it could supply the missing international ingredient -- emergency

financing for cash-starved emerging markets. It wouldn't affect American mortgage

rates, but it could help the profitability of American multinational companies

by creating a healthier global environment for their businesses.”[47]

In September of 2008, Jeffrey Garten wrote an article for the Financial Times

in which he stated that, “Even if the US’s massive financial rescue

operation succeeds, it should be followed by something even more far-reaching

– the establishment of a Global Monetary Authority to oversee markets that

have become borderless.” He emphasized the “need for a new Global

Monetary Authority. It would set the tone for capital markets in a way that

would not be viscerally opposed to a strong public oversight function with rules

for intervention, and would return to capital formation the goal of economic

growth and development rather than trading for its own sake.”

Further, the “GMA would be a reinsurer or discounter for certain obligations

held by central banks. It would scrutinise the regulatory activities of national

authorities with more teeth than the IMF has and oversee the implementation

of a limited number of global regulations. It would monitor global risks and

establish an effective early warning system with more clout to sound alarms

than the BIS has.” Moreover, “The biggest global financial companies

would have to register with the GMA and be subject to its monitoring, or be

blacklisted. That includes commercial companies and banks, but also sovereign

wealth funds, gigantic hedge funds and private equity firms.” He recommends

that its board “include central bankers not just from the US, UK, the eurozone

and Japan, but also China, Saudi Arabia and Brazil. It would be financed by

mandatory contributions from every capable country and from insurance-type premiums

from global financial companies – publicly listed, government owned, and

privately held alike.”[48]

In October of 2008, it was reported that Morgan Stanley CEO John Mack stated

that, “it may take continued international coordination to fully unlock

the credit markets and resolve the financial crisis, perhaps even by forming

a new global body to oversee the process.”[49]

In late October of 2008, Jeffrey Garten wrote an article for Newsweek in which

he stated that, “leaders should begin laying the groundwork for establishing

a global central bank.” He explained that, “There was a time when

the U.S. Federal Reserve played this role [as governing financial authority

of the world], as the prime financial institution of the world's most powerful

economy, overseeing the one global currency. But with the growth of capital

markets, the rise of currencies like the euro and the emergence of powerful

players such as China, the shift of wealth to Asia and the Persian Gulf and,

of course, the deep-seated problems in the American economy itself, the Fed

no longer has the capability to lead single-handedly.”

He explains the criteria and operations of a world central bank, saying that,

“It could be the lead regulator of big global financial institutions, such

as Citigroup or Deutsche Bank, whose activities spill across borders,”

as well as “act as a bankruptcy court when big global banks that operate

in multiple countries need to be restructured. It could oversee not just the

big commercial banks, such as Mitsubishi UFJ, but also the "alternative"

financial system that has developed in recent years, consisting of hedge funds,

private-equity groups and sovereign wealth fundsall of which are now substantially

unregulated.” Further, it “could have influence over key exchange

rates, and might lead a new monetary conference to realign the dollar and the

yuan, for example, for one of its first missions would be to deal with the great

financial imbalances that hang like a sword over the world economy.”

He further postulates that, “A global central bank would not eliminate

the need for the Federal Reserve or other national central banks, which will

still have frontline responsibility for sound regulatory policies and monetary

stability in their respective countries. But it would have heavy influence over

them when it comes to following policies that are compatible with global growth

and financial stability. For example, it would work with key countries to better

coordinate national stimulus programs when the world enters a recession, as

is happening now, so that the cumulative impact of the various national efforts

do not so dramatically overshoot that they plant the seeds for a crisis of global

inflation. This is a big threat as government spending everywhere goes into

overdrive.”[50]

In January of 2009, it was reported that, “one clear solution to avoid

a repeat of the problems would be the establishment of a "global central

bank" – with the IMF and World Bank being unable to prevent the financial

meltdown.” Dr. William Overholt, senior research fellow at Harvard's Kennedy

School, formerly with the Rand Institute, gave a speech in Dubai in which he

said that, “To avoid another crisis, we need an ability to manage global

liquidity. Theoretically that could be achieved through some kind of global

central bank, or through the creation of a global currency, or through global

acceptance of a set of rules with sanctions and a dispute settlement mechanism.”[51]

Guillermo Calvo, Professor of Economics, International and Public Affairs at

Columbia University wrote an article for VOX in late March of 2009. Calvo is

the former Chief Economist of the Inter-American Development Bank, and is currently

a Research Associate at the National Bureau of Economic Research (NBER) and

President of the International Economic Association and the former Senior Advisor

in the Research Department of the IMF.

He wrote that, “Credit availability is not ensured by stricter financial

regulation. In fact, it can be counterproductive unless it is accompanied by

the establishment of a lender of last resort (LOLR) that radically softens the

severity of financial crisis by providing timely credit lines. With that aim

in mind, the 20th century saw the creation of national or regional central banks

in charge of a subset of the capital market. It has now become apparent that

the realm of existing central banks is very limited and the world has no institution

that fulfils the necessary global role. The IMF is moving in that direction,

but it is still too small and too limited to adequately do so.”

He advocates that, “the first proposal that I would like to make is that

the topic of financial regulation should be discussed together with the issue

of a global lender of last resort.” Further, he proposed that, “international

financial institutions must be quickly endowed with considerably more firepower

to help emerging economies through the deleveraging period.”[52]

A “New World Order” in Banking

In March of 2008, following the collapse of Bear Stearns, Reuters reported on

a document released by research firm CreditSights, which said that, “Financial

firms face a ‘new world order’,” and that, “More industry

consolidation and acquisitions may follow after JPMorgan Chase & Co.”

Further, “In the event of future consolidation, potential acquirers identified

by CreditSights include JPMorganChase, Wells Fargo, US Bancorp, Goldman Sachs

and Bank of America.”[53]

In June of 2008, before he was Treasury Secretary in the Obama administration,

Timothy Geithner, as head of the New York Federal Reserve, wrote an article

for the Financial Times following his attendance at the 2008 Bilderberg conference,

in which he wrote that, “Banks and investment banks whose health is crucial

to the global financial system should operate under a unified regulatory framework,”

and he said that, “the US Federal Reserve should play a "central role"

in the new regulatory framework, working closely with supervisors in the US

and around the world.”[54]

In November of 2008, The National, a prominent United Arab Emirate newspaper,

reported on Baron David de Rothschild accompanying Prime Minister Gordon Brown

on a visit to the Middle East, although not as a “part of the official

party” accompanying Brown. Following an interview with the Baron, it was

reported that, “Rothschild shares most people’s view that there is

a new world order. In his opinion, banks will deleverage and there will be a

new form of global governance.”[55]

In February of 2009, the Times Online reported that a “New world order

in banking [is] necessary,” and that, “It is increasingly evident

that the world needs a new banking system and that it should not bear much resemblance

to the one that has failed so spectacularly.”[56] But of course, the ones

that are shaping this new banking system are the champions of the previous banking

system. The solutions that will follow are simply the extensions of the current

system, only sped up through the necessity posed by the current crisis.

An Emerging Global Government

A recent article in the Financial Post stated that, “The danger in the

present course is that if the world moves to a “super sovereign” reserve

currency engineered by experts, such as the “UN Commission of Experts”

led by Nobel laureate economist Joseph Stiglitz, we would give up the possibility

of a spontaneous money order and financial harmony for a centrally planned order

and the politicization of money. Such a regime change would endanger not only

the future value of money but, more importantly, our freedom and prosperity.”[57]

Further, “An uncomfortable characteristic of the new world order may well

turn out to be that global income gaps will widen because the rising powers,

such as China, India and Brazil, regard those below them on the ladder as potential

rivals.” The author further states that, “The new world order thus

won't necessarily be any better than the old one,” and that, “What

is certain, though, is that global affairs are going to be considerably different

from now on.”[58]

In April of 2009, Robert Zoellick, President of the World Bank, said that,

“If leaders are serious about creating new global responsibilities or governance,

let them start by modernising multilateralism to empower the WTO, the IMF, and

the World Bank Group to monitor national policies.”[59]

David Rothkopf, a scholar at the Carnegie Endowment for International Peace,

former Deputy Undersecretary of Commerce for International Trade in the Clinton

administration, and former managing director of Kissinger and Associates, and

a member of the Council on Foreign Relations, recently wrote a book titled,

Superclass: The Global Power Elite and the World They are Making, of which he

is certainly a member. When discussing the role and agenda of the global “superclass”,

he states that, “In a world of global movements and threats that don’t

present their passports at national borders, it is no longer possible for a

nation-state acting alone to fulfill its portion of the social contract.”[60]

He writes that, “even the international organizations and alliances we

have today, flawed as they are, would have seemed impossible until recently,

notably the success of the European Union – a unitary democratic state

the size of India. The evolution and achievements of such entities against all

odds suggest not isolated instances but an overall trend in the direction of

what Tennyson called “the Parliament of Man,” or ‘universal law’.”

He states that he is “optimistic that progress will continue to be made,”

but it will be difficult, because it “undercuts many national and local

power structures and cultural concepts that have foundations deep in the bedrock

of human civilization, namely the notion of sovereignty.”[61]

He further writes that, “Mechanisms of global governance are more achievable

in today’s environment,” and that these mechanisms “are often

creative with temporary solutions to urgent problems that cannot wait for the

world to embrace a bigger and more controversial idea like real global government.”[62]

In December of 2008, the Financial Times ran an article written by Gideon Rachman,

a past Bilderberg attendee, who wrote that, “for the first time in my life,

I think the formation of some sort of world government is plausible,” and

that, “A ‘world government’ would involve much more than co-operation

between nations. It would be an entity with state-like characteristics, backed

by a body of laws. The European Union has already set up a continental government

for 27 countries, which could be a model. The EU has a supreme court, a currency,

thousands of pages of law, a large civil service and the ability to deploy military

force.”

He then asks if the European model could “go global,” and states that

there are three reasons for thinking that may be the case. First, he states,

“it is increasingly clear that the most difficult issues facing national

governments are international in nature: there is global warming, a global financial

crisis and a ‘global war on terror’.” Secondly, he states that,

“It could be done,” largely as a result of the transport and communications

revolutions having “shrunk the world.” Thirdly, this is made possible

through an awakening “change in the political atmosphere,” as “The

financial crisis and climate change are pushing national governments towards

global solutions, even in countries such as China and the US that are traditionally

fierce guardians of national sovereignty.”

He quoted an adviser to French President Nicolas Sarkozy as saying, “Global

governance is just a euphemism for global government,” and that the “core

of the international financial crisis is that we have global financial markets

and no global rule of law.” However, Rachman states that any push towards

a global government “will be a painful, slow process.” He then states

that a key problem in this push can be explained with an example from the EU,

which “has suffered a series of humiliating defeats in referendums, when

plans for “ever closer union” have been referred to the voters. In

general, the Union has progressed fastest when far-reaching deals have been

agreed by technocrats and politicians – and then pushed through without

direct reference to the voters. International governance tends to be effective,

only when it is anti-democratic. [Emphasis added]”[63]

In November of 2008, the United States National Intelligence Council (NIC),

the US intelligence community’s “center for midterm and long-term

strategic thinking,” released a report that it produced in collaboration

with numerous think tanks, consulting firms, academic institutions and hundreds

of other experts, among them are the Atlantic Council of the United States,

the Wilson Center, RAND Corporation, the Brookings Institution, American Enterprise

Institute, Texas A&M University, the Council on Foreign Relations and Chatham

House in London.[64]

The report, titled, Global Trends 2025: A Transformed World, outlines the current

global political and economic trends that the world may be going through by

the year 2025. In terms of the financial crisis, it states that solving this

“will require long-term efforts to establish a new international system.”[65]

It suggests that as the “China-model” for development becomes increasingly

attractive, there may be a “decline in democratization” for emerging

economies, authoritarian regimes, and “weak democracies frustrated by years

of economic underperformance.” Further, the dollar will cease to be the

global reserve currency, as there would likely be a “move away from the

dollar.”[66]

It states that the dollar will become “something of a first among equals

in a basket of currencies by 2025. This could occur suddenly in the wake of

a crisis, or gradually with global rebalancing.”[67] The report elaborates

on the construction of a new international system, stating that, “By 2025,

nation-states will no longer be the only – and often not the most important

– actors on the world stage and the ‘international system’ will

have morphed to accommodate the new reality. But the transformation will be

incomplete and uneven.” Further, it would be “unlikely to see an overarching,

comprehensive, unitary approach to global governance. Current trends suggest

that global governance in 2025 will be a patchwork of overlapping, often ad

hoc and fragmented efforts, with shifting coalitions of member nations, international

organizations, social movements, NGOs, philanthropic foundations, and companies.”

It also notes that, “Most of the pressing transnational problems –

including climate change, regulation of globalized financial markets, migration,

failing states, crime networks, etc. – are unlikely to be effectively resolved

by the actions of individual nation-states. The need for effective global governance

will increase faster than existing mechanisms can respond.”[68]

The report discusses the topic of regionalism, stating that, “Greater Asian

integration, if it occurs, could fill the vacuum left by a weakening multilaterally

based international order but could also further undermine that order. In the

aftermath of the 1997 Asian financial crisis, a remarkable series of pan-Asian

venturesthe most significant being ASEAN + 3began to take root. Although

few would argue that an Asian counterpart to the EU is a likely outcome even

by 2025, if 1997 is taken as a starting point, Asia arguably has evolved more

rapidly over the last decade than the European integration did in its first

decade(s).” It further states that, “movement over the next 15 years

toward an Asian basket of currenciesif not an Asian currency unit as a

third reserveis more than a theoretical possibility.”

It elaborates that, “Asian regionalism would have global implications,

possibly sparking or reinforcing a trend toward three trade and financial clusters

that could become quasi-blocs (North America, Europe, and East Asia).”

These blocs “would have implications for the ability to achieve future

global World Trade Organization agreements and regional clusters could compete

in the setting of trans-regional product standards for IT, biotech, nanotech,

intellectual property rights, and other ‘new economy’ products.”[69]

Of great importance to address, and reflecting similar assumptions made by Rachman

in his article advocating for a world government, is the topic of democratization,

saying that, “advances are likely to slow and globalization will subject

many recently democratized countries to increasing social and economic pressures

that could undermine liberal institutions.” This is largely because “the

better economic performance of many authoritarian governments could sow doubts

among some about democracy as the best form of government. The surveys we consulted

indicated that many East Asians put greater emphasis on good management, including

increasing standards of livings, than democracy.” Further, “even in

many well-established democracies, surveys show growing frustration with the

current workings of democratic government and questioning among elites over

the ability of democratic governments to take the bold actions necessary to

deal rapidly and effectively with the growing number of transnational challenges.”[70]

Conclusion

Ultimately, what this implies is that the future of the global political economy

is one of increasing moves toward a global system of governance, or a world

government, with a world central bank and global currency; and that, concurrently,

these developments are likely to materialize in the face of and as a result

of a decline in democracy around the world, and thus, a rise in authoritarianism.

What we are witnessing is the creation of a New World Order, composed of a totalitarian

global government structure.

In fact, the very concept of a global currency and global central bank is authoritarian

in its very nature, as it removes any vestiges of oversight and accountability

away from the people of the world, and toward a small, increasingly interconnected

group of international elites.

As Carroll Quigley explained in his monumental book, Tragedy and Hope, “[T]he

powers of financial capitalism had another far-reaching aim, nothing less than

to create a world system of financial control in private hands able to dominate

the political system of each country and the economy of the world as a whole.

This system was to be controlled in a feudalist fashion by the central banks

of the world acting in concert, by secret agreements arrived at in frequent

private meetings and conferences. The apex of the system was to be the Bank

for International Settlements in Basle, Switzerland, a private bank owned and

controlled by the world’s central banks which were themselves private corporations.”[71]

Indeed, the current “solutions” being proposed to the global financial

crisis benefit those that caused the crisis over those that are poised to suffer

the most as a result of the crisis: the disappearing middle classes, the world’s

dispossessed, poor, indebted people. The proposed solutions to this crisis represent

the manifestations and actualization of the ultimate generational goals of the

global elite; and thus, represent the least favourable conditions for the vast

majority of the world’s people.

It is imperative that the world’s people throw their weight against these

“solutions” and usher in a new era of world order, one of the People’s

World Order; with the solution lying in local governance and local economies,

so that the people have greater roles in determining the future and structure

of their own political-economy, and thus, their own society. With this alternative

of localized political economies, in conjunction with an unprecedented global

population and international democratization of communication through the internet,

we have the means and possibility before us to forge the most diverse manifestation

of cultures and societies that humanity has ever known.

The answer lies in the individual’s internalization of human power and

destination, and a rejection of the externalization of power and human destiny

to a global authority of which all but a select few people have access to. To

internalize human power and destiny is to realize the gift of a human mind,

which has the ability to engage in thought beyond the material, such as food

and shelter, and venture into the realm of the conceptual. Each individual possesses

– within themselves – the ability to think critically about themselves

and their own life; now is the time to utilize this ability with the aim of

internalizing the concepts and questions of human power and destiny: Why are

we here? Where are we going? Where should we be going? How do we get there?

The supposed answers to these questions are offered to us by a tiny global elite

who fear the repercussions of what would take place if the people of the world

were to begin to answer these questions themselves. I do not know the answers

to these questions, but I do know that the answers lie in the human mind and

spirit, that which has overcome and will continue to overcome the greatest of

challenges to humanity, and will, without doubt, triumph over the New World

Order.

Endnotes

[1] Ambrose Evans-Pritchard, The G20 moves the world a step closer to a global currency. The Telegraph: April 3, 2009: http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/5096524/The-G20-moves-the-world-a-step-closer-to-a-global-currency.html

[2] Robert Winnett, Financial Crisis: Gordon Brown calls for 'new Bretton Woods'. The Telegraph: October 13, 2008: http://www.telegraph.co.uk/finance/financetopics/financialcrisis/3189517/Financial-Crisis-Gordon-Brown-calls-for-new-Bretton-Woods.html

[3] Gordon Brown, Out of the Ashes. The Washington Post: October 17, 2008: http://www.washingtonpost.com/wp-dyn/content/article/2008/10/16/AR2008101603179.html

[4] Gordon Rayner, Global financial crisis: does the world need a new banking

'policeman'? The Telegraph: October 8, 2008: http://www.telegraph.co.uk/finance/financetopics/financialcrisis/3155563/Global-financial-crisis-does-the-world-need-a-new-banking-policeman.html

[5] Benn Steil, The End of National Currency. Foreign Affairs: Vol. 86, Issue 3, May/June 2007: pages 83-96

[6] Jonathan Tirone, ECB's Nowotny Sees Global `Tri-Polar' Currency System Evolving. Bloomberg: October 19, 2008: http://www.bloomberg.com/apps/news?pid=20601087&sid=apjqJKKQvfDc&refer=home

[7] BBC, South America nations found union. BBC News: May 23, 2008: http://news.bbc.co.uk/2/hi/americas/7417896.stm

[8] CNews, South American nations to seek common currency. China View: May 26, 2008: http://news.xinhuanet.com/english/2008-05/27/content_8260847.htm

[9] AME Info, GCC: Full steam ahead to monetary union. September 19, 2005: http://www.ameinfo.com/67925.html

[10] John Irish, GCC Agrees on Monetary Union but Signals Delay in Common Currency. Reuters: June 10, 2008: http://www.arabnews.com/?page=6§ion=0&article=110727&d=10&m=6&y=2008

[11] Forbes, TIMELINE-Gulf single currency deadline delayed beyond 2010. Forbes: March 23, 2009: http://www.forbes.com/feeds/afx/2009/03/24/afx6204462.html

[12] Agencies, 'GCC need not rush to form single currency'. Business 24/7: March 26, 2009: http://www.business24-7.ae/articles/2009/3/pages/25032009/03262009_4e19de908b174f04bfb3c37aec2f17b3.aspx

[13] Barry Eichengreen, International Monetary Arrangements: Is There a Monetary Union in Asia's Future? The Brookings Institution: Spring 1997: http://www.brookings.edu/articles/1997/spring_globaleconomics_eichengreen.aspx

[14] atimes.com, After European now Asian Monetary Union? Asia Times Online: September 8, 2001: http://www.atimes.com/editor/CI08Ba01.html

[15] ASEAN, China, Japan, SKorea, ASEAN Makes Moves for Asian Monetary Fund. Association of Southeast Asian Nations: May 6, 2005: http://www.aseansec.org/afp/115.htm

[16] Reuven Glick, Does Europe's Path to Monetary Union Provide Lessons for East Asia? Federal Reserve Bank of San Francisco: August 12, 2005: http://www.frbsf.org/publications/economics/letter/2005/el2005-19.html

[17] AFP, Asian Monetary Fund may be needed to deal with future shocks. Channel News Asia: July 2, 2007: http://www.channelnewsasia.com/stories/afp_world_business/view/285700/1/.html

[18] AFX News Limited, East Asia monetary union 'feasible' but political will lacking – ADB. Forbes: September 19, 2007: http://www.forbes.com/feeds/afx/2007/09/19/afx4133743.html

[19] Lin Li, ASEAN discusses financial, monetary integration. China View: April 2, 2008: http://news.xinhuanet.com/english/2008-04/02/content_7906391.htm

[20] Paul De Grauwe, Economics of Monetary Union. Oxford University Press, 2007: pages 109-110

[21] Heather Milkiewicz and Paul R. Masson, Africa's Economic MorassWill a Common Currency Help? The Brookings Institution: July 2003: http://www.brookings.edu/papers/2003/07africa_masson.aspx

[22] John Gahamanyi, Rwanda: African Central Bank Governors Discuss AU Financial Institutions. The New Times: August 23, 2008: http://allafrica.com/stories/200808230124.html

[23] Eric Ombok, African Union, Nigeria Plan Accord on Central Bank. Bloomberg: March 2, 2009: http://www.bloomberg.com/apps/news?pid=20601116&sid=afoY1vOnEMLA&refer=africa

[24] Ministry of Foreign Affairs, AFRICA IN THE QUEST FOR A COMMON CURRENCY. Republic of Kenya: March 2009: http://www.mfa.go.ke/mfacms/index.php?option=com_content&task=view&id=346&Itemid=62

[25] Herbert Grubel, The Case for the Amero. The Fraser Institute: September 1, 1999: Page 4: http://www.fraserinstitute.org/Commerce.Web/publication_details.aspx?pubID=2512

[26] Herbert Grubel, The Case for the Amero. The Fraser Institute: September 1, 1999: Page 17: http://www.fraserinstitute.org/Commerce.Web/publication_details.aspx?pubID=2512

[27] Thomas Courchene and Richard Harris, From Fixing to Monetary Union: Options for North American Currency Integration. C.D. Howe Institute, June 1999: Page 22:

http://www.cdhowe.org/display.cfm?page=research-fiscal&year=1999

[28] Thomas Courchene and Richard Harris, From Fixing to Monetary Union: Options for North American Currency Integration. C.D. Howe Institute, June 1999: Page 23:

http://www.cdhowe.org/display.cfm?page=research-fiscal&year=1999

[29] Barrie McKenna, Dodge Says Single Currency ‘Possible’. The Globe and Mail: May 21, 2007

[30] Consider a Continental Currency, Jarislowsky Says. The Globe and Mail: November 23: 2007:

http://www.theglobeandmail.com/servlet/story/LAC.20071123.RDOLLAR23/TPStory/?query=%22Steven%2BChase%22b

[31] CNN, CNN Larry King Live. Transcripts: October 8, 2007: http://transcripts.cnn.com/TRANSCRIPTS/0710/08/lkl.01.html

[32] Herbert Grubel, Fix the Loonie. The Financial Post: January 18, 2008:

http://www.nationalpost.com/opinion/story.html?id=245165

[33] Todd Harrison, How realistic is a North American currency? Market Watch: January 28, 2009: http://www.marketwatch.com/news/story/Do-we-need-a-North/story.aspx?guid={D10536AF-F929-4AF9-AD10-250B4057A907}

[34] Get ready for the phoenix. The Economist: Vol. 306: January 9, 1988: pages 9-10

[35] IMF, IMF Survey. Volume 27, No. 9: May 11, 1998: pages 146-147:

http://www.imf.org/external/pubs/ft/survey/pdf/051198.pdf

[36] Judy Shelton, Hearing on Exchange Rate Stability in International Finance. Testimony of Judy Shelton Before the United States House of Representatives Committee on Banking and Financial Services: May 21, 1999: http://financialservices.house.gov/banking/52199she.htm

[37] ECB, The euro and the dollar - new imperatives for policy co-ordination. Speeches and Interviews: September 18, 2000: http://www.ecb.int/press/key/date/2000/html/sp000918.en.html

[38] IMF, One World, One Currency: Destination or Delusion? Economic Forums and International Seminars: November 8, 2000: http://www.imf.org/external/np/exr/ecforums/110800.htm

[39] Robert A. Mundell, World Currency. The Works of Robert A. Mundell: http://www.robertmundell.net/Menu/Main.asp?Type=5&Cat=09&ThemeName=World%20Currency

[40] Itar-Tass, Russia proposes creation of global super-reserve currency. ITAR-TASS News Agency: March 16, 2009: http://www.itar-tass.com/eng/level2.html?NewsID=13682035&PageNum=0

[41] Jamil Anderlini, China calls for new reserve currency. The Financial Times: March 23, 2009: http://www.ft.com/cms/s/0/7851925a-17a2-11de-8c9d-0000779fd2ac.html

[42] CFR, A Conversation with Timothy F. Geithner. Council on Foreign Relations Transcripts: March 25, 2009: http://www.cfr.org/publication/18925/

[43] news.com.au, UN backs new new global currency reserve. The Sunday Telegraph: March 29, 2009: http://www.news.com.au/business/story/0,27753,25255091-462,00.html

[44] Ashima Goyal, Is world ready for a global currency? The Economic Times: April 3, 2009: http://economictimes.indiatimes.com/ET-Debate/Is-world-ready-for-a-global-currency/articleshow/4352581.cms